U.S. Economic Dashboard

Here are summaries of some of the go-to data points I look to for an indication which way the U.S economy is heading. I will try to keep them regularly updated based on new data released.

Latest Economy Post

Interest Rates (as of May 2023)

May 9, 2023

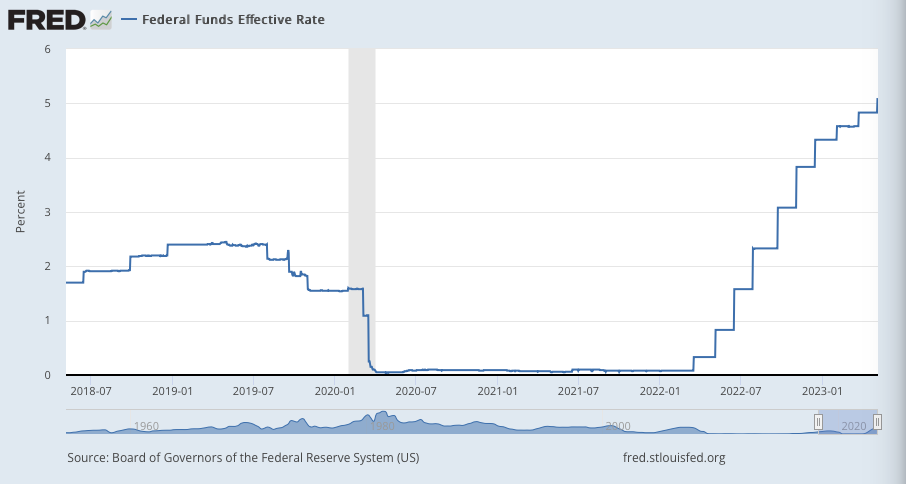

At its May 2023 meeting, the Federal Reserve’s FOMC announced it was raising the Fed Funds Rate by 25 bps to a range between 5.00% and 5.25%. This was widely expected to be the last in a series of rate hikes that began in March 2022.

The Fed’s statement can be found here.

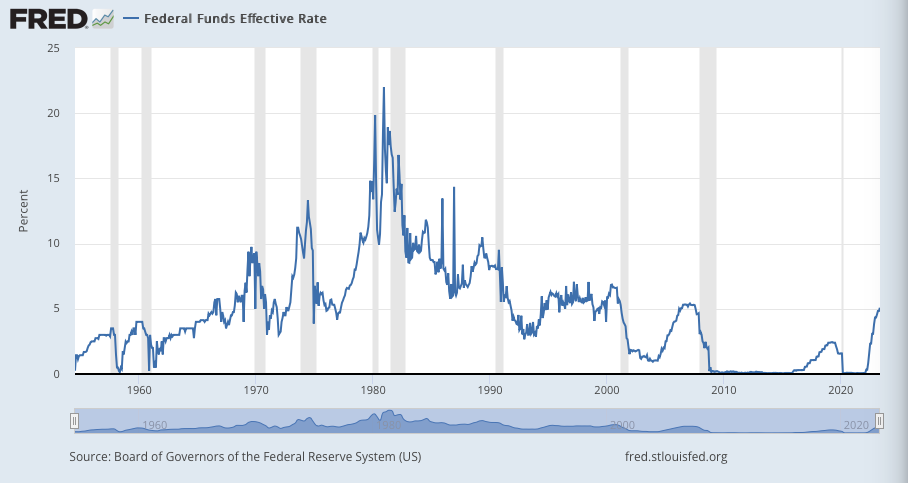

This chart offers a longer-term perspective on the Fed Funds rate, which are now at their highest level since August 2007.

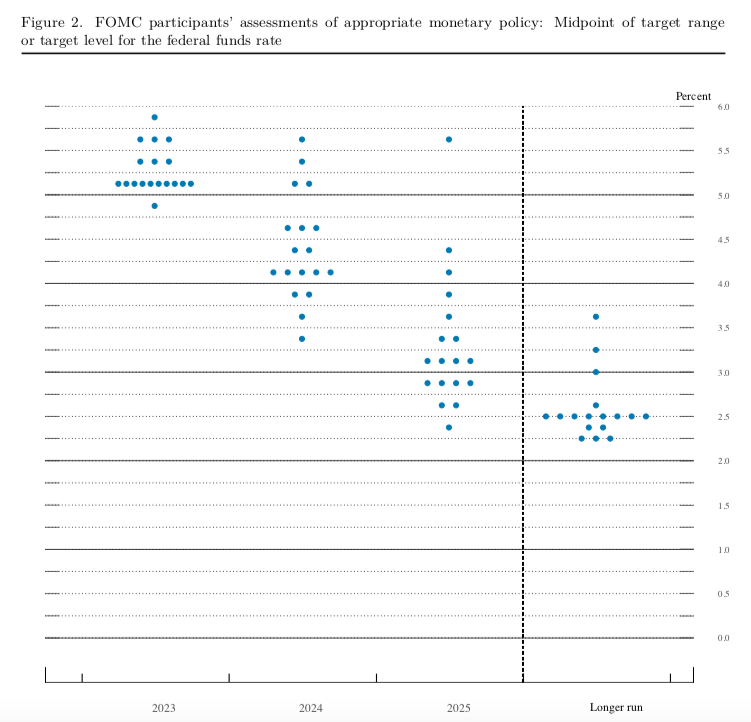

Following its March meeting, the Fed released this latest “dot plot” (published quarterly) of where FOMC members expect the Fed Funds rate to move in the future. The median expectation was for one more 25 bps rate hike (which happened in May), before starting to pull back.

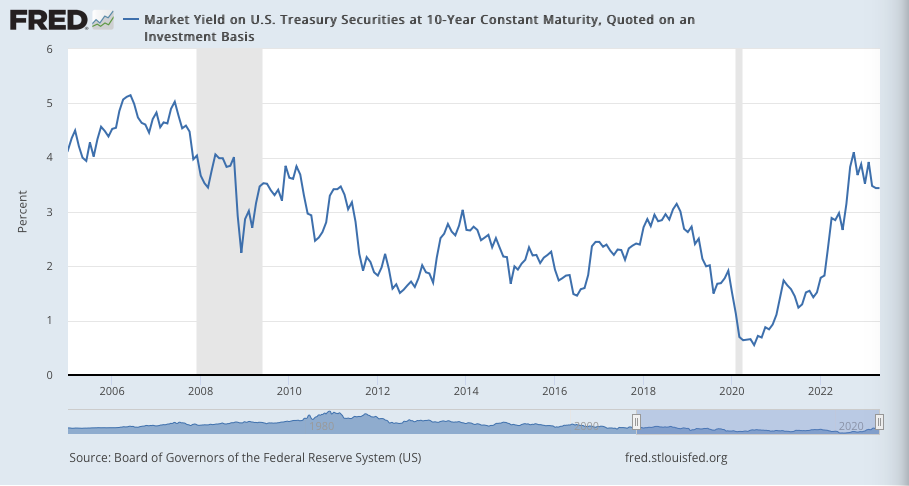

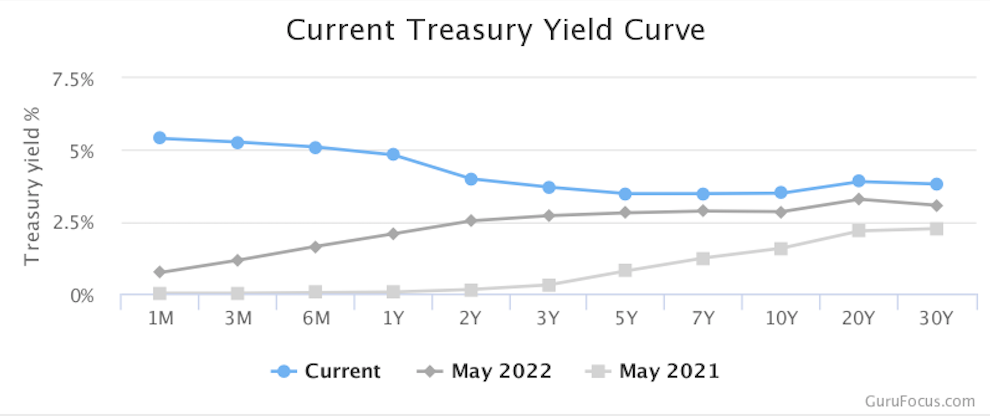

As of May 5, the yield on 10-Year Treasuries is at 3.44%, down from 3.88% at the end of 2022.

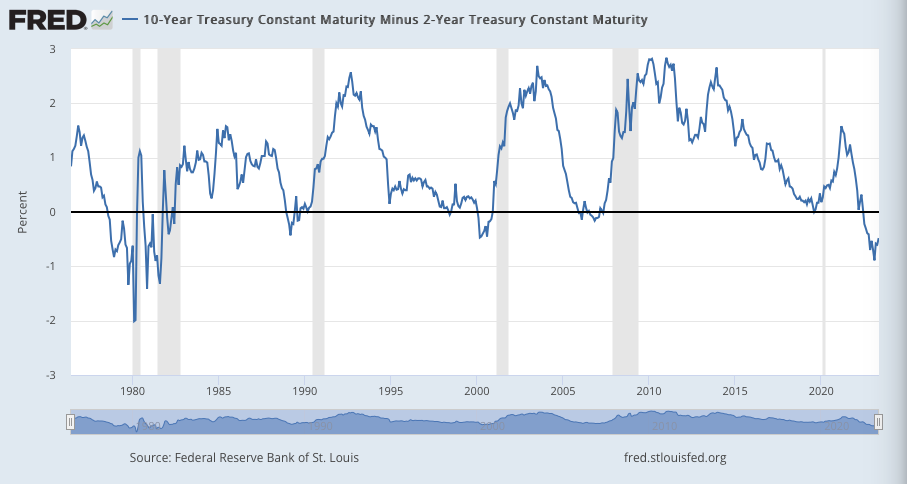

The spread between 10-year and 2-year Treasury yields remains negative, since July 2022. A negative “yield curve” is often seen as a leading recession indicator.

The U.S. Treasury yield curve (currently inverted, as of May 9), compared to one year ago and two years ago, when it was upward-sloping.

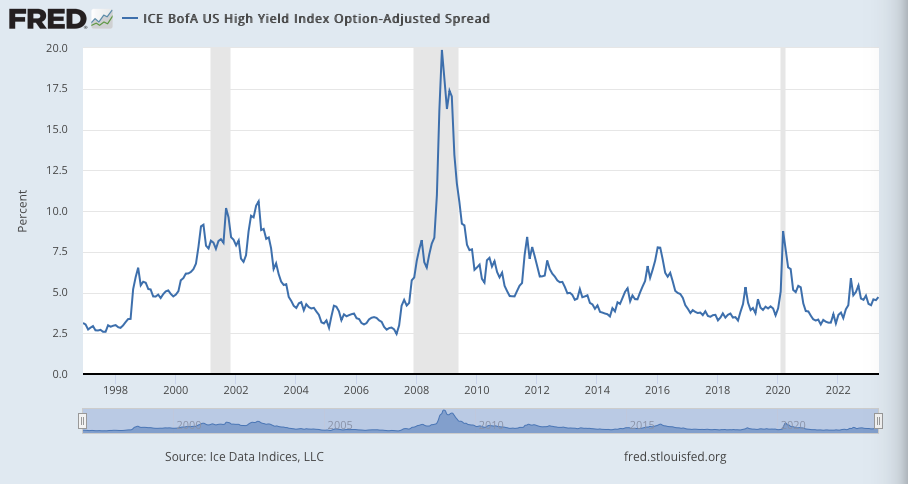

As of May 8, the spread on high-yield bonds stands at 4.47%, down from 4.81% at the end of 2022, despite a recent modest spike. The spread is often seen to reflect perceived credit risk in the economy.

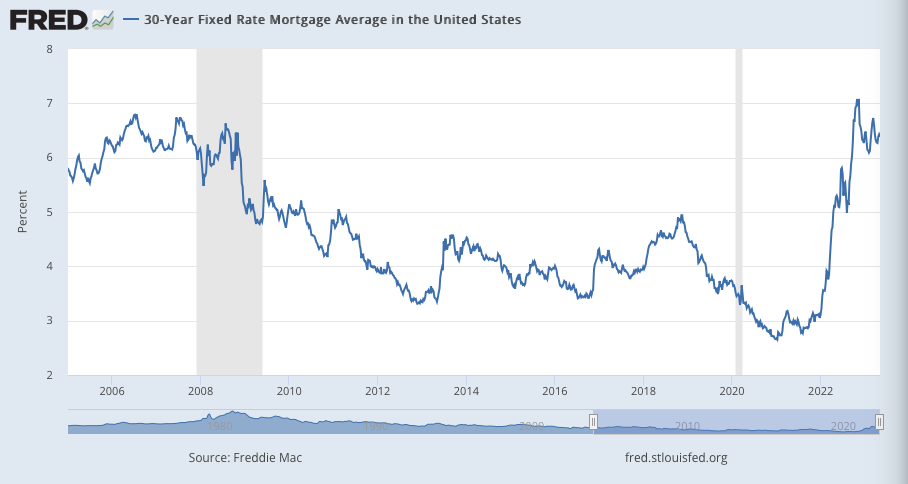

As of May 4, the U.S. 30-Year Fixed Mortgage Rate stands at 6.39%, down from a recent peak of 7.08% in October. Mortgage rates have risen sharply from 3.11% at the end of 2021, driven by Fed rate hikes.

Videos

Some of my recent appearances talking about the economy and markets.

Speaking with CNBC’s Martin Soong about the challenges of investing and doing business in China in the Xi Jinping Era. (June 2022)

Talking to CNBC’s Dan Murphy about why slower growth in early 2022 wouldn’t (and didn’t) derail the Fed’s continued rate hikes. (April 2022)

More with CNBC’s Dan Murphy, explaining the interesting historical background behind Elon Musk’s jibe about reintroducing cocaine into Coca-Cola.

Talking with CNN’s Richard Quest about the Chinese government’s crackdown on technology firms. (July 2021)

Selected Articles

Some of my previously published articles, blog posts, and other material focused on the economy and markets.

GMF: Towards a New Architecture for the International Economic Order