February 4, 2023

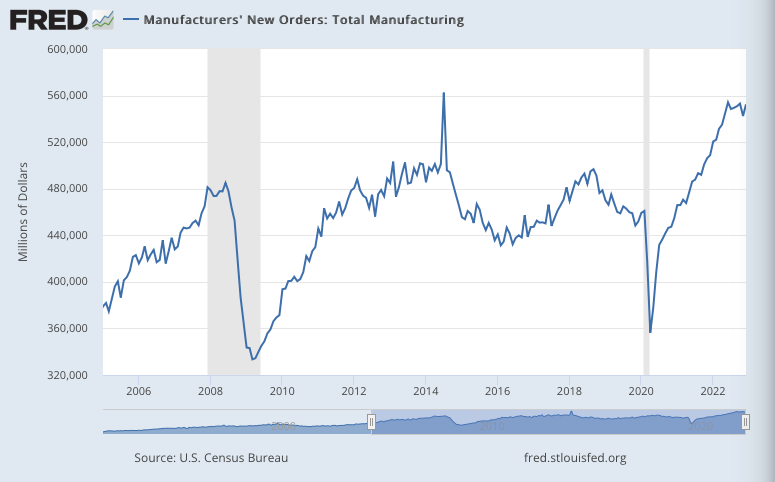

U.S. factory orders rose +1.8% m/m in December, up +8.6% from a year ago. Keep in mind these numbers are not adjusted for inflation, and the PCE price index was up +5.0% y/y in December. For Q4 as a whole, orders were flat q/q, up +8.7% from a year before. For 2022 as a whole, orders were up +11.7% from 2021, not adjusting for inflation, which averaged +6.2% y/y.

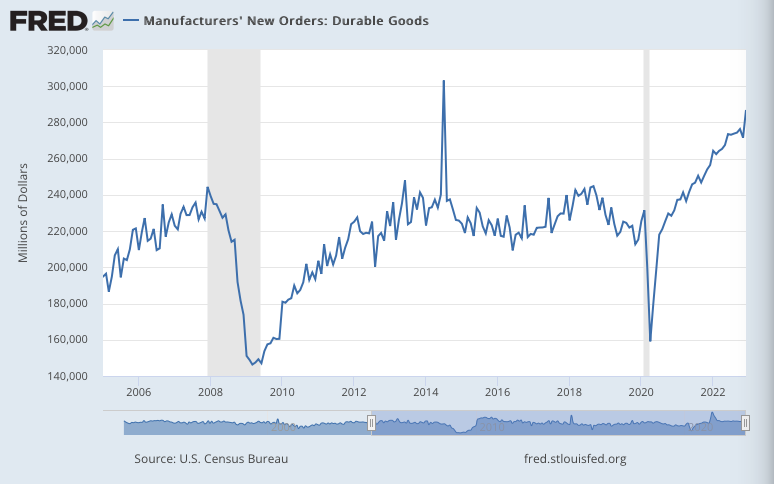

US durable goods orders spiked up +5.6% m/m in December, up +11.7% from a year ago (not adjusting for inflation). For Q4 as a whole, orders rose +1.6% q/q, up +9.6% from a year before. For 2022 as a whole, orders were up +10.5% over 2021.

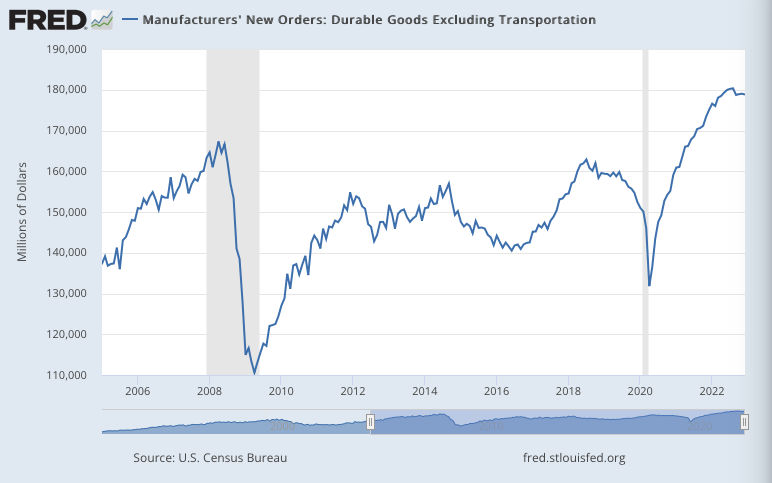

Durable goods orders excluding transportation fell -0.2% m/m in December, up just +2.0% from a year ago (well below inflation). For Q4, orders fell -0.5% q/q, up just +3.2% from a year before. For 2022 as a whole, orders were up +6.4% from 2021 – roughly flat in real terms.

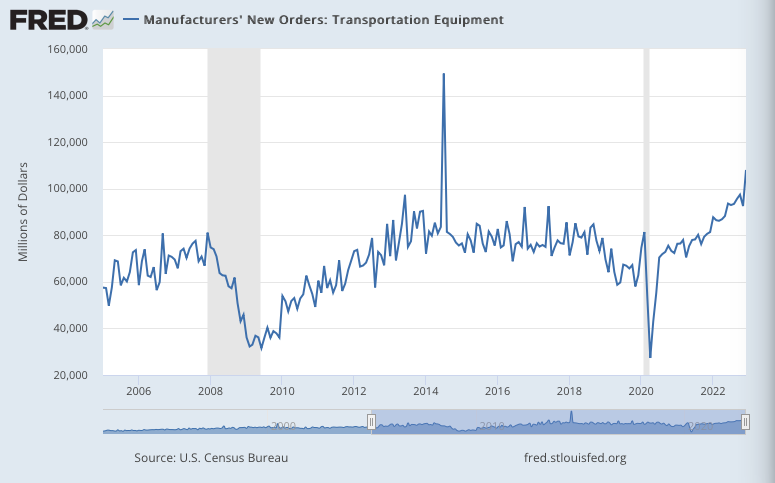

The increase in durable goods orders in December was mainly due to transportation equipment, which spiked up +16.9% m/m, up +32.7% from a year ago. For Q4, orders rose +5.6% q/q, up +23.4% from a year before. For 2022 as a whole, orders were up +19.2% over 2021.

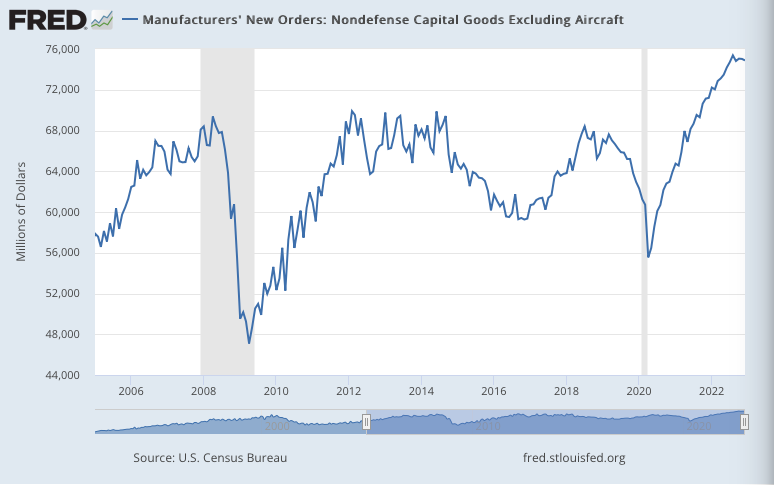

US orders for core capital goods, often seen as a leading indicator of business investment, fell -0.1% m/m in December, up +5.1% from a year ago (before adjusting for inflation). For Q4, orders were flat q/q, up +5.6% y/y. For 2022 as a whole, orders were up +8.4% over 2021.

Leave a Reply