May 3, 2023

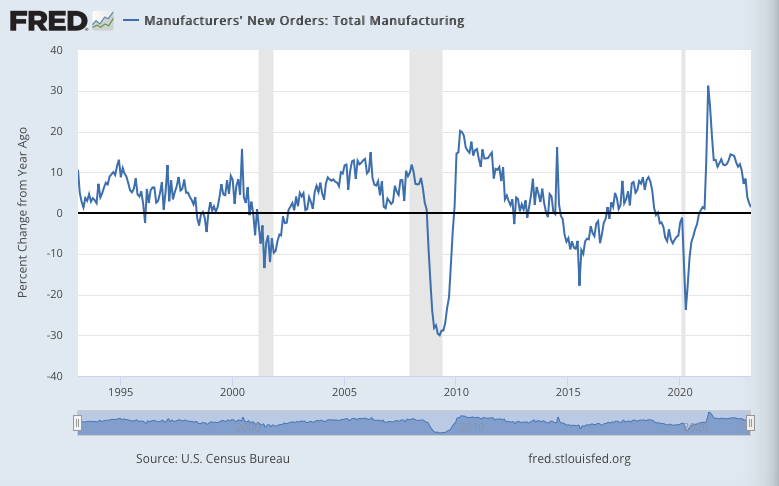

U.S. factory orders rose +0.9% m/m in March, up just 1.4% from a year ago. Keep in mind these numbers are not adjusted for inflation, and the PCE price index was up +4.2% y/y in March, which suggests a real contraction. For Q1 as a whole, order fell -2.1% q/q, up just +2.5% from a year before.

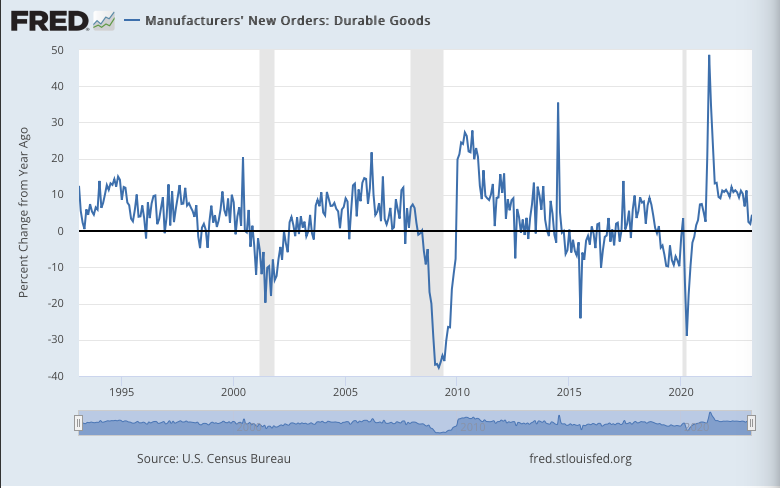

US durable goods orders rose +3.2% m/m in March, up +4.5% from a year ago (only just a bit higher than inflation, suggesting they were almost flat in real terms). For Q1 as a whole, orders fell -2.2% q/q, up just +3.0% from a year before (below inflation).

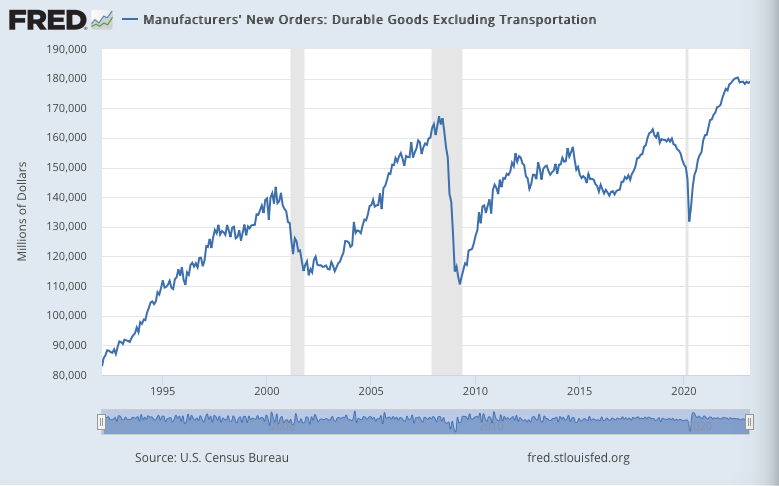

Durable goods orders excluding transportation rose +0.2% m/m in March, up just +0.5% from a year ago (well below inflation). For Q1 as a whole, orders were all but flat at +0.1% q/q, up just +1.1% from a year before.

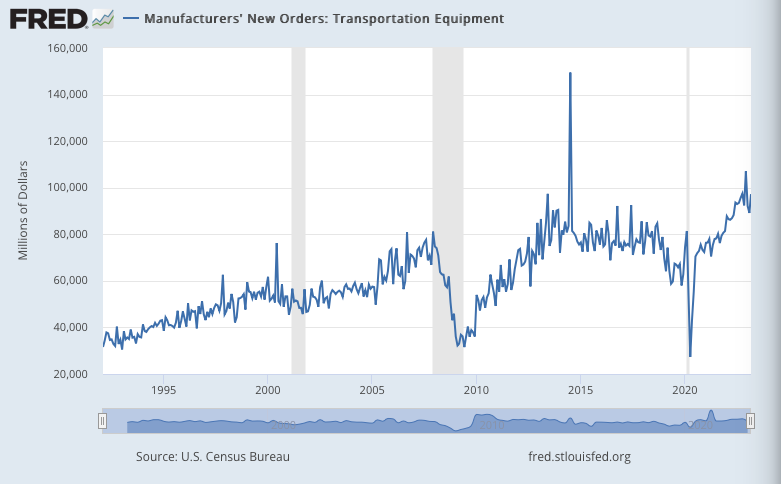

Volatile orders for transportation goods rose +9.0% m/m in March, up +12.8% from a year ago. For Q1 as a whole, however, orders fell -6.2% q/q, up +6.9% from a year before.

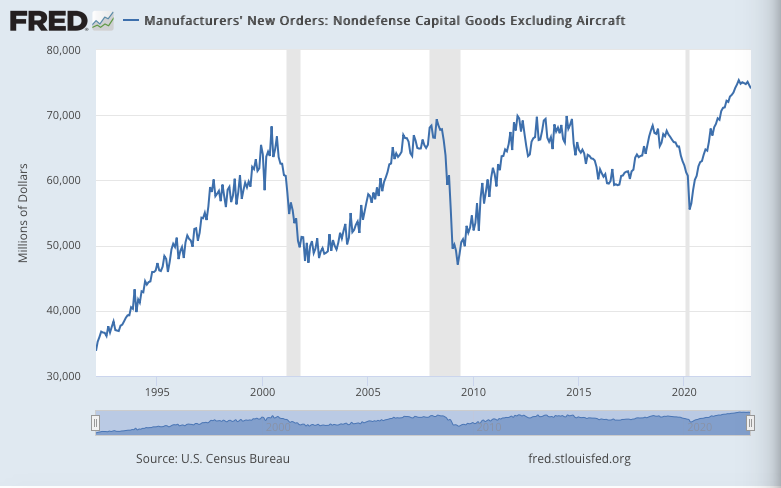

US orders for core capital goods, often seen as a leading indicator of business investment, fell -0.6% m/m in March, up +1.7% from a year ago (well below inflation). For Q1 as a whole, orders fell -0.4% q/q, up +3.1% y/y (before adjusting for inflation).

Leave a Reply